Notifications

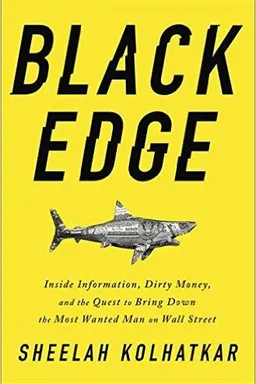

The story of billionaire trader Steven Cohen, the rise and fall of his hedge fund SAC Capital, and the largest insider trading investigation in history for readers of The Big Short, Den of Thieves, and Dark Money

Steven A. Cohen changed Wall Street. He and his fellow pioneers of the hedge fund industry didn't lay railroads, build factories, or invent new technologies. Rather, they made their billions through speculation, by placing bets in the market that turned out to be right more often than wrong and for this, they gained not only extreme personal wealth but formidable influence throughout society. Hedge funds now oversee more than $3 trillion in assets, and the competition between them is so fierce that traders will do whatever they can to get an edge.

Cohen was one of the industry ...Read More

The story of billionaire trader Steven Cohen, the rise and fall of his hedge fund SAC Capital, and the largest insider trading investigation in history for readers of The Big Short, Den of Thieves, and Dark Money

Steven A. Cohen changed Wall Street. He and his fellow pioneers of the hedge fund industry didn't lay railroads, build factories, or invent new technologies. Rather, they made their billions through speculation, by placing bets in the market that turned out to be right more often than wrong and for this, they gained not only extreme personal wealth but formidable influence throughout society. Hedge funds now oversee more than $3 trillion in assets, and the competition between them is so fierce that traders will do whatever they can to get an edge.

Cohen was one of the industry ...Read More

Ratings

Ratings